Summary: Explore the evolution of USD to INR exchange rates from 1947 to 2025. Understand the factors behind currency fluctuations and their impact on India’s economy. Read on for detailed insights.

The US dollar serves as the world’s most dominant currency. Regarded as the benchmark currency, the US dollar determines the value of other currencies in the universal market. The US dollar is also one of the most commonly used currencies in international investment and trade. Trading with the dollar is much easier than any other currency.

The emergence of the dollar as an indispensable medium of exchange began after World War I placed restrictions on exchanges. Since then, the dollar has been enjoying worldwide attention. In light of this, the Indian currency, like various others, is compared against the dollar to determine its value.

The value of the US Dollar (USD) against the Indian Rupee (INR) has always been a topic of interest, especially for those involved in international trade, travel, or investment. For example, if you traveled to the US in 2000, you’d get about 44.94 INR per USD. But in 2025, that number is closer to 87.81 INR in February.

In this blog, we’re taking a trip down memory lane to see how the exchange rate between the US dollar (USD) and the Indian rupee (INR) has changed since India’s independence in 1947.

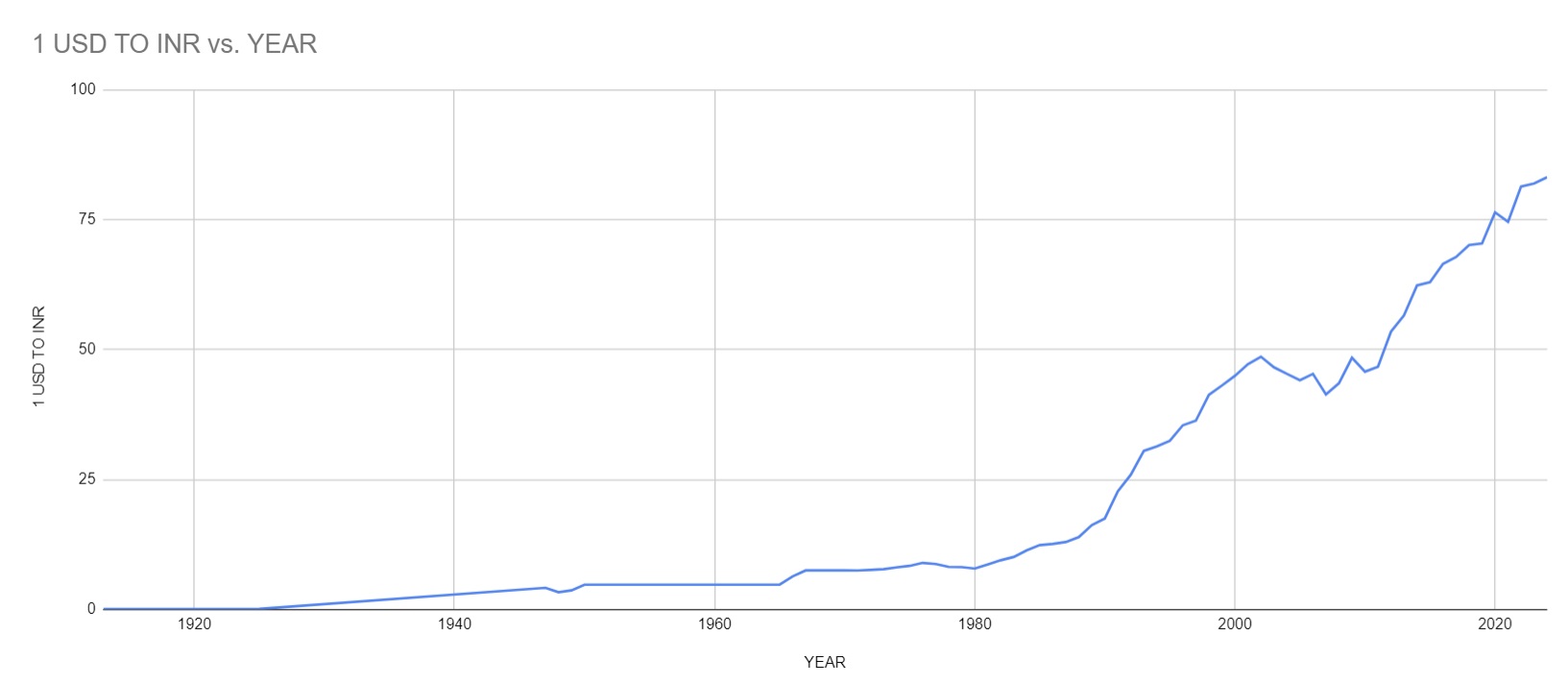

How the USD to INR Rate Has Changed from 1947 to 2025

The 1 USD to INR exchange rate has always had extreme volatility since its inception and has seen a lot of fluctuations over the years. We have brought you the USD to INR exchange rate history i.e. 1 USD to INR values table ranging from 1947 till date so that you can see the change in INR’s value.

| YEAR | Value of 1 US Dollar in Indian Rupee | YEAR | Value of 1 US Dollar in Indian Rupee | YEAR | Value of 1 US Dollar in Indian Rupee |

|---|---|---|---|---|---|

| 1913 | 0.09 | 1972 | 7.59 | 1999 | 43.06 |

| 1925 | 0.1 | 1973 | 7.74 | 2000 | 44.94 |

| 1947 | 3.3 | 1974 | 8.1 | 2001 | 47.19 |

| 1948 | 3.31 | 1975 | 8.38 | 2002 | 48.61 |

| 1949 | 3.67 | 1976 | 8.96 | 2003 | 46.58 |

| 1950 | 4.76 | 1977 | 8.74 | 2004 | 45.32 |

| 1951 | 4.76 | 1978 | 8.19 | 2005 | 44.1 |

| 1952 | 4.76 | 1979 | 8.13 | 2006 | 45.31 |

| 1953 | 4.76 | 1980 | 7.86 | 2007 | 41.35 |

| 1954 | 4.76 | 1981 | 8.66 | 2008 | 43.51 |

| 1955 | 4.76 | 1982 | 9.46 | 2009 | 48.41 |

| 1956 | 4.76 | 1983 | 10.1 | 2010 | 45.73 |

| 1957 | 4.76 | 1984 | 11.36 | 2011 | 46.67 |

| 1958 | 4.76 | 1985 | 12.37 | 2012 | 53.44 |

| 1959 | 4.76 | 1986 | 12.61 | 2013 | 56.57 |

| 1960 | 4.76 | 1987 | 12.96 | 2014 | 62.33 |

| 1961 | 4.76 | 1988 | 13.92 | 2015 | 62.97 |

| 1962 | 4.76 | 1989 | 16.23 | 2016 | 66.46 |

| 1963 | 4.76 | 1990 | 17.5 | 2017 | 67.79 |

| 1964 | 4.76 | 1991 | 22.74 | 2018 | 70.09 |

| 1965 | 4.76 | 1992 | 25.92 | 2019 | 70.39 |

| 1966 | 6.36 | 1993 | 30.49 | 2020 | 76.38 |

| 1967 | 7.5 | 1994 | 31.37 | 2021 | 74.57 |

| 1968 | 7.5 | 1995 | 32.43 | 2022 | 81.35 |

| 1969 | 7.5 | 1996 | 35.43 | 2023 | 81.94 |

| 1970 | 7.5 | 1997 | 36.31 | 2024 | 84.83 |

| 1971 | 7.5 | 1998 | 41.26 | 2025 | 86.83 |

What Was the Value of 1 USD to INR in 1947?

Now there’s some debate about the exact exchange rate in 1947. Some sources suggest it might have been close to 1 USD = 1 INR. Honestly, it is nothing more than a myth. If you are thinking that exchanging 1 USD for INR in 1947 would have got you 1 Rupee exactly, then, sadly, that’s not true. ‘Why‘ do you ask? Here’s the answer:

1. When India gained independence in 1947, the Indian Rupee was not pegged to the US Dollar, and there was no balance sheet parity to support a 1:1 exchange rate. Additionally, prior to independence, India was under British rule, and the Indian Rupee was pegged to the British Pound.

2. From 1927 to 1966, 1 British Pound was valued at 13 INR, and this fixed exchange rate remained in place until 1966 when India experienced its first major devaluation. Therefore, after independence, the Indian Rupee continued to peg to the British Pound at a rate of 1 Rupee = 1 Shilling and 6 Pence, equivalent to 13 1/3 INR per British Pound.

3. At that time, the British Pound was valued at approximately 4 USD, which means that the actual value of 1 USD in 1947 would have been around 3.30 INR — not 1 INR.

Note: India became a republic nation in 1950. The constitution of India came into existence in 1952. At that time 1 USD was equal to 4.766 INR or 1 USD = 4.76 NCU. (NCU is National Currency Unit)

Also Read: USD To INR currency conversion: How to avoid a common travel blunder

Why the Indian Rupee Has Depreciated Against the US Dollar: Key Contributing Factors

Now the real question is–why has the value of the Indian rupee changed so much since 1947 to date? Well, our forex experts have come up with a detailed answer.

1. Pre-Independence Era — Before 1947

During the pre-independence era, India was under British colonial rule, which significantly impacted its economy, including the value of its currency. As a result, the value of the rupee was closely tied to the economic conditions in Britain.

Like many global currencies at the time, the British Pound was convertible to USD within a one percent margin of fixed rates, while the US dollar was pegged to gold, as determined by the Bretton Woods Agreement. The Great Depression of the 1930s devastated the global economy, and India, as a British colony, suffered doubly.

2. India’s Independence — 1947

Indian currency began to be measured against the US dollar in 1947 after India gained its independence. The value of 1 INR then could be taken as 1 USD, considering that the national balance sheet was free from any credit or debit.

However, the value of Indian currency was derived from the British pound. The British Pound was valued at approximately 4 USD, and hence the value of the Indian Rupee back in 1947 was around 3.30, considering 1 Rupee = 1 Shilling and 6 Pence, equivalent to 13 1/3 INR per British Pound.

Simply put, the British pound served as the basis for the value of Indian currency, it played a role in the INR depreciation. However, this pricing of the rupee versus the British pound persisted because there was no accepted method of currency comparison until 1944.

3. Post-Independence Era — 1950 to Early 1990s

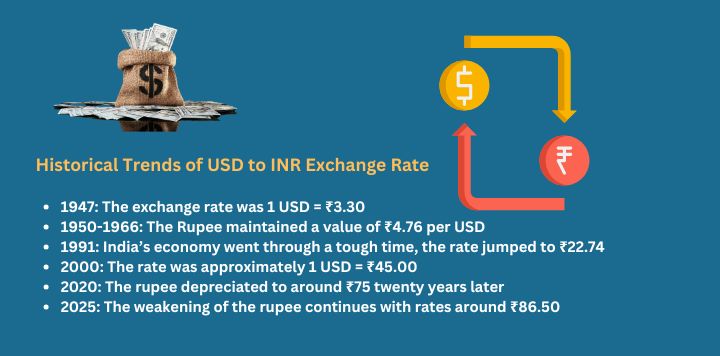

The Indian Rupee maintained a value of ₹4.76 against the US dollar from 1950 until 1966. However, India’s economic standing began to decline due to its weakened credit reputation in global markets. Contributing factors included the 1962 India-China war, the 1965 India-Pakistan war, and the severe drought of 1966, which ultimately devalued the rupee to ₹7.50 per dollar by 1967.

The rupee faced further challenges in 1974, falling to ₹8.10 per dollar due to the 1973 oil crisis when OAPEC (Organisation of Arab Petroleum Exporting Countries) reduced oil production. India had to borrow foreign currency to manage the crisis, leading to political and economic instability that further eroded the rupee’s value. Throughout the 1980s, the rupee continued to weaken, and by the early 1990s, it had dropped to ₹17.50 per dollar.

4. Pre-21st Century Era — 1990s to 2000

India’s economy went through a tough time in the 1990s. Interest payments accounted for 39% of the revenue that the government collected at the time. The fiscal deficit was reduced to 7.8% of GDP, and India was on the verge of being declared a defaulter in the international market. Furthermore, the devaluation changed the exchange rate from 1 USD to 25.92 INR in 1992. The Indian currency value kept falling since then!

To overcome this, the Indian government initiated economic liberalization policies in the 1990s which started bearing fruit. Increased foreign investment and a growing Information Technology (IT) sector boosted India’s foreign exchange reserves. This kept the rupee value somewhat stable and even gained strength for a brief period in the early 2000s.

5. 21st Century — 2001 to 2025

Starting at roughly ₹47 per USD in 2001, the rupee depreciated to around ₹75 twenty years later. India’s economic growth during this period led to increased demand for imports which resulted in a current account deficit, where the value of imports exceeded the value of exports. To overcome this, the RBI had to sell foreign exchange reserves, which put downward pressure on the rupee. Other global events like the 2008 financial crisis also had a significant adverse impact on the value of the Indian Rupee.

The depreciation of the Indian Rupee (INR) against the US Dollar (USD) continued from 2020 to 2023, with the exchange rate reaching around ₹83 per USD in 2023. This continued depreciation can be attributed to several factors, including the COVID-19 pandemic, crude oil prices, trade imbalances and current account deficit, capital outflows, and geopolitical tensions.

Now in 2025, the situation for the Indian Rupee continues to worsen, with the currency steadily weakening against the US Dollar. As of February 2025, the INR has dropped to around ₹86.83, continuing a depreciation trend observed in recent months. Several factors have contributed to this ongoing rupee depreciation, so let’s discuss them in detail below.

Why Has the Value of 1 USD Climbed to ₹86.83 in February 2025?

In the last few months, several factors have contributed to the steady depreciation of the Indian Rupee against the US Dollar, pushing the exchange rate to new heights. In fact, the Indian currency is the third worst performer among Asian currencies. Let’s understand the key reasons behind this:

1. Strong Dollar Index: The US Dollar has strengthened significantly, due to the Federal Reserve’s caution in lowering interest rates as well as the potential impact of higher tariffs on foreign exports. The persistent strength of the USD makes it more attractive to investors. This strength in the dollar index has put pressure on emerging market currencies, including the INR.

2. Global Trade Tariff Concerns: The rhetoric around increasing tariffs has sparked discussions about potential implications for global trade and India’s economy. Increasing tariffs can significantly impact India’s economy by making its exports less competitive on the global market, potentially leading to a negative trade balance and putting downward pressure on the Indian Rupee (INR) due to reduced foreign exchange inflows from exports.

3. Rising Gold Imports: India has seen an increase in gold imports, which has contributed to the widening of the current account deficit. A higher deficit puts additional pressure on the INR, as more foreign currency is required to pay for imports. This situation is exacerbated by foreign portfolio outflows, where investors are moving their capital to other markets like China, which are perceived as more stable or offering better returns. These outflows further weaken the INR.

4. RBI’s Strategic Shift: The Reserve Bank of India (RBI) has strategically relaxed its control over the INR, allowing it to depreciate more freely against the USD. This shift in strategy marks a departure from the RBI’s previous defense mechanisms, which were more rigid. By allowing the INR to depreciate, the RBI might be aiming to boost export competitiveness, although this comes with the risk of increased import costs and inflation.

5. USD to INR Rates in January 2025:

The highest exchange rate is ₹87.78.

The average exchange rate is ₹₹86.54.

The lowest exchange rate is ₹85.55.

Check out here for next 12 month USD to INR Forecast

General Factors Affecting USD-INR Exchange Rates

A fluctuating exchange rate between INR and USD is not something new. Currency values fluctuate every day, and so does the value of the rupee in relation to the US dollar. Multiple factors have influenced the USD-INR exchange rate over the years. Five such general factors are listed below.

1. INR-USD exchange rates are affected by the inflation rate in India and USA.

2. The interest rate is another important factor in determining INR-USD exchange rates.

3. Exchange rates are influenced by government debt as well.

4. Terms of trade are the next factor to consider. It is defined by the ratio of the index of a country’s export prices to the index of its import prices.

5. Last but not least, the INR-USD rate is also affected by the political stability in both India and the United States.

The Future of the USD to INR Exchange Rate

Looking ahead, the USD to INR exchange rate will likely be shaped by a mix of factors both at home in India and in the USA. On the home front, India’s growth in sectors like technology and manufacturing could give the rupee a boost, especially if the country manages to keep inflation and fiscal deficits in check. But it’s not all smooth sailing—India will need to tackle challenges like trade imbalances to really strengthen the rupee. Meanwhile, what happens in the US will also matter a lot. If the US Federal Reserve decides to hike interest rates, it could make the dollar more attractive to investors, which will again put pressure on the rupee.

Globally, geopolitical tensions and market sentiments will also play a big role. If there are any major conflicts or trade issues, investors might prefer the safety of the dollar, which could weaken the rupee. On the flip side, if India can boost its exports and cut down on imports, especially in energy, it could help balance things out. Plus, if India continues to innovate in areas like digital technology, it might attract more foreign investment, which would be good news for the rupee. So, while there are plenty of opportunities for the rupee to strengthen, a lot will depend on how both domestic and international factors play out.

Also Read:-

1 AED to INR from 2008 to 2025, Historical Exchange Rates Explained

1 CAD to INR from 1947 to 2025, Historical Exchange Rates Explained

1 EUR to INR from 1990 to 2025, Historical Exchange Rates Explained

1 AUD to INR from 1966 till now, Historical Exchange Rates Explained

1 THB to INR from 1947 to 2025, Historical Exchange Rates Explained

1 INR to PKR from 1947 to 2025, Historical Exchange Rates Trend Explained

1 GBP to INR from 1947 to 2025: Historical Exchange Rates Explained