Thai Baht (THB) Overview

The Thai Baht (THB) is the official currency of Thailand, The Land of Smiles. Its currency code, THB, is recognized globally, and it is symbolized by ฿. Managed by the Bank of Thailand, the Baht is subdivided into 100 satangs, similar to cents in Canadian or US dollars. The Thai Baht has proven to be one of the most stable Southeast Asian currencies. In fact, it was one of the best-performing currencies in the year 2018.

Thai Baht Currency Facts

| THB Stats | THB Profile |

| Name: | Thai Baht |

| Nickname: | Baht |

| Symbol: | ฿, THB |

| Date of Introduction: | 1897 |

| THB Currency in Circulation: | Approximately ฿2.2 trillion |

| Banknotes: | Frequently Used: ฿20, ฿50, ฿100, ฿500, ฿1000 Rarely Used: ฿10, ฿20 |

| THB Notes Made of | Polymer |

| Current THB Coins: | 25 Satangs, 50 Satangs, ฿1, ฿2, ฿5, ฿10 |

| THB Coins Made of: | Nickel-plated steel, cupro-nickel |

| Countries using THB Currency: | Thailand |

History of Thai Baht (THB)

The Thai Baht (THB) has a rich history that spans centuries, evolving from its ancient roots to becoming one of the oldest currencies in circulation today. The journey of the Baht is marked by key milestones, economic crises, and transformations that have shaped its present-day form.

1. Origins of Thai Currency:

The Baht has been the official currency of Thailand since 1897 and has been in use even before it was considered the official currency. The original Thai currency was known as the Tical, used until 1925 on banknotes. The Baht, the Thai name for the currency, has been in use since the 19th century. Both Tical and Baht were initially units of weight, and coins were issued in both silver and gold.

2. Introduction of Decimalization:

King Rama V (Chulalongkorn) implemented significant reforms in the early 20th century.

Decimalization of the Thai Baht was introduced, replacing the traditional Tical, making the currency more modern and efficient. The shift to decimalization facilitated easier transactions and paved the way for the contemporary financial system in Thailand.

3. Evolution of Baht's Value:

The Thai Baht was based on the unit of mass (15 grams of silver) and remained tied to silver until the late 19th century. The currency's value was initially based on a fixed exchange with the British pound sterling and underwent periodic adjustments. Over the years, the Baht's pegging evolved, including ties to the Japanese yen and gold. In 1950, it was pegged to the US dollar.

4. Financial Crisis and Exchange Rate Fluctuations:

The Baht faced a pivotal moment during the Asian Financial Crisis in 1997. Previously pegged to the US dollar, the Bank of Thailand allowed the Baht to float freely in the foreign exchange market. The decision led to a significant depreciation, with the exchange rate reaching 56 Baht to 1 USD. This move triggered a wave of bankruptcies among Thai businesses that borrowed in dollars but earned revenues in Baht.

5. Post-Crisis Economic Recovery:

Following the Asian Financial Crisis, Thailand undertook measures to stabilize its economy and rebuild investor confidence. The country implemented structural reforms and financial sector restructuring to foster economic recovery. The resilience demonstrated during this period contributed to the long-term stability and growth of the Thai Baht.

6. Political Influence and Economic Development Plans:

In 2014, Thailand experienced a significant political shift when the military government took control through a coup d'état. After the takeover, the government implemented a comprehensive twenty-year economic development plan. A twenty-year economic development plan was introduced, aiming to achieve developed-economy status by 2037.

Significance of the Thai Baht (THB)

The Thai Baht (THB) has become a significant player in the global foreign exchange (FX) market, due to Thailand's impressive economic rise. In 2019, it secured the 24th spot among the most-traded currencies. Thailand's economic trajectory witnessed exceptional growth, especially from 1950 to 2000, with an impressive annual growth rate of 6.6%.

However, the Asian financial crisis of 1997 marked a significant turning point, resulting in a considerable slowdown in growth. Despite the challenges, the Thai economy still managed to expand at an average annual rate of 5% from 1999 to 2005, contributing to a substantial reduction in poverty from 67% in 1986 to a mere 7.2% in 2015.

Current Thai Baht (THB) Notes & Coins

1. Thai Baht (THB) currency comprises various coins and banknotes, reflecting the economic landscape of Thailand.

2. For coins, denominations range from 1 to 50 satangs, along with ฿1, ฿2, ฿5, and ฿10 coins.

3. Thai banknotes are available in denominations of ฿20, ฿50, ฿100, ฿500, and ฿1,000.

4. The ongoing 2018 series of Thai banknotes serves as a testament to the country's cultural identity.

5. Featuring on the obverse side is a portrait of King Maha Vajiralongkorn, and the reverse sides of each denomination offer a unique historical touch, showcasing images of past rulers who have played a pivotal role in Thailand's heritage.

6. The country's economy is heavily dependent on exports, which account for approximately 66% of its Gross Domestic Product (GDP).

7. Among its key exports are computers, electrical appliances, textiles, and jewelry. Additionally, Thailand is known for its fishing, agriculture, and tourism industries.

How to Spot Counterfeit Thai Baht Notes?

Identifying counterfeit Thai Baht notes requires a keen eye and attention to specific security features inherent to authentic currency. For instance, authentic Thai Baht notes are printed on specialized paper made from cotton fiber, making it significantly more durable and long-lasting than regular paper. You can also hold the banknote up to the light from either side to observe the watermark featuring the image of the King.

Besides this, a series of Arabic numbers is located in the bottom left corner of each bill. Each banknote also incorporates a security thread of alternating colors. When held up to the light, the entire thread becomes visible. Moreover, the thread includes letters and numbers representing the value of the banknote. Bills with denominations of 100, 500, and 1000 baht feature a vertical stripe of metallic hologram foil in the left margin. This stripe, visible on the front of the bills, appears to change color and form new shapes when viewed from different angles.

How Do We Measure The Value Of THB?

The value of THB is measured using a THB Index. It essentially operates as a comparative measure, assessing the Thai Baht against a basket of currencies. This basket typically includes significant currencies from major regions, thereby providing a comprehensive overview of the baht’s performance.

What Is the Thai Baht Index (THBX)?

The THB Index is a weighted average of the value of the Thai Baht currency against a basket of other major currencies. Here are a few key points about the THBX:

1. The THBX is calculated based on the weighted average of the value of the baht against other major international currencies. The weights assigned to each currency reflect their relative importance in international trade.

2. A rising THB Index signals a strengthened baht when measured against the basket of currencies. This uptrend implies that the baht has gained value in comparison to its counterparts.

3. Conversely, a declining index suggests a weakened baht in relation to the basket, indicating a decrease in its value on the global stage.

4. Note that the THBX only measures the baht’s performance against a specific set of currencies, neglecting other potentially influential factors.

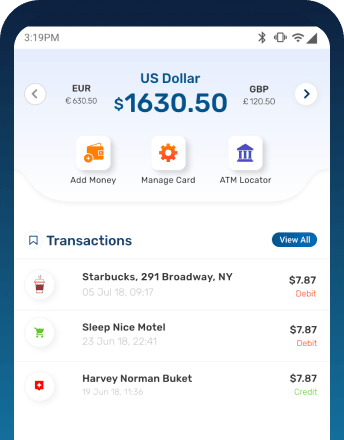

Benefits of buying/selling THB from BookMyForex

You can buy or sell THB online at the best rates with BookMyForex, a leading forex platform in India. On our site, you will find the live & transparent THB rates as the rates get updated every 3 seconds. You get the following benefits when buying or selling THB :

1. BookMyForex offers the best rate for THB to INR, or vice versa

2. You can place your order online 24x7 at live rates

3. Rates are compared across hundreds of money changers in your area

4. Same-day delivery of THB currency notes is available

5. Freeze your desired rates for up to 3 days by paying a refundable deposit of 2%