Vietnamese Dong (VND) Overview

The Vietnamese Dong, denoted by the ISO code VND, is Vietnam's official currency. In Vietnamese, the term "dong" signifies money. Introduced in 1946, the dong replaced the separate currencies of North and South Vietnam later in 1978. Considered an exotic currency due to minimal interest in the forex market and global finance, the dong was loosely tied to the US dollar until 2016. Initially, the VND was subdivided into hao, but as hao ceased to be accepted as legal tender, the dong became the smallest unit of the currency. Issued by the State Bank of Vietnam, the VND is heavily affected by inflation.

Vietnamese Dong Currency Facts

| VND Stats | VND Profile |

| Name: | Vietnamese Dong |

| Nickname: | Dong |

| Symbol: | ₫ |

| Date of Introduction: | May 31, 1946 (78 years ago) |

| VND Currency in Circulation: | ₫1,800 trillion |

| Banknotes: | Frequently used: ₫200, ₫500, ₫1000, ₫2000, ₫5000, ₫10000, ₫20000, ₫50000 Rarely used: ₫100, ₫200000, ₫500000 |

| Banknotes Made of: | Polymer |

| Countries using VND | Vietnam |

History of the Vietnamese Dong

The Vietnamese Dong, introduced in 1946, underwent revaluations and unification, leading to the issuance of multiple banknote denominations over time. Here is a comprehensive and historical overview of the currency:

1. Introduction of the Dong:

The Vietnamese dong, initially introduced by the North Vietnam government, formerly known as the Viet Minh, in 1946, replaced the French Indochinese piastre. The currency underwent revaluations in 1951 and 1959, at rates of 100 to 1 and 1000 to 1, respectively.

2. Divided Dongs:

Following the division of Vietnam, South Vietnam issued its own currency in 1953, also called the Dong. Both currencies underwent several devaluations due to war and economic instability

3. Unification and Revaluation:

Vietnam's unification in 1978 led to the introduction of a single dong, with one new dong equivalent to 0.8 Southern dong or one Northern dong. On September 14, 1985, the dong underwent revaluation, with the new dong valued at 10 old VND.

4. Pegging to US Dollar:

After reunification in 1978, a single Dong was established, pegged to the US dollar. Initial optimism faced the harsh reality of hyperinflation, forcing further devaluations and economic reforms.

5. Evolution of Banknotes:

The State Bank of Vietnam issued notes in 1978, including denominations of 5 hao, 1 dong, 5 dong, 10 dong, 20 dong, and 50 dong. Additional notes of 2 VND and 10 VND were introduced in 1980, followed by 30 VND and 100 VND in 1981. However, these notes were gradually withdrawn in 1985 as they lost value.

6. New Series of Banknotes:

In 1985, a new series of banknotes ranging from 5 hao to 500 VND were introduced. Persistent inflation led to the introduction of higher denomination notes, including 200, 1000, 2000, and 5000 VND in 1987, 10,000 and 50,000 VND in 1990, 20,000 VND in 1991, 100,000 VND in 1994, 500,000 VND in 2003, and 200,000 VND in 2006.

Significance of the Vietnamese Dong (VND)

The Vietnamese dong has been facing chronic inflation and holds the status of one of the poorest currencies globally. Despite this, the dong is closely managed against the US dollar, maintaining a stable exchange rate relationship. Throughout the 2010s, the exchange rate was around 19,500 Vietnamese dong per US dollar, indicating a consistent valuation.

Vietnam's economic transformation from an agricultural society to a flourishing center for electronics manufacturing has fueled its rapid growth, positioning it as one of the fastest-growing economies globally. Notably, substantial investments from companies like Samsung Electronics have helped this transition, contributing significantly to Vietnam's economic expansion.

During currency fluctuations across Asia, the Vietnamese dong stood out for its stability. While currencies like the Thai baht and the Malaysian ringgit experienced surges and the Philippine peso faced devaluation, the dong remained relatively unchanged, showcasing its resilience and stability in the face of regional economic shifts.

Current Vietnamese Dong Notes & Coins

1. Currently, Vietnam circulates banknotes ranging from 100 VND to 500,000 VND, covering various denominations.

2. In 2003, Vietnam initiated the replacement of cotton notes with plastic polymer ones, citing cost reduction as a primary motive.

3. However, this move faced opposition from several newspapers, which pointed out printing defects and alleged favoritism in printing contracts.

4. The 2003 series of polymer notes, which replaced the old cotton ones of the same denominations, including 200 VND, 500 VND, 1000 VND, 2000 VND, and 5,000 VND, are now widely distributed and recognized.

5. On June 7, 2007, the government ceased production of 50,000 VND and 100,000 VND cotton notes, which were no longer in circulation by September 1, 2007.

6. Vietnam transitioned away from using coins in 2012 due to inflation and a move towards digital payments. While commemorative coins are still minted, they are not intended for everyday use.

7. Previously, Vietnamese Dong coins existed in denominations of 200, 500, 1,000, 2,000, and 5,000 VND. They were made of a variety of materials, including aluminum, steel, and brass.

8. However, due to inflation, their value became negligible, and they were eventually withdrawn from circulation.

9. Besides managing circulating banknotes, the State Bank of Vietnam plays a key role in ensuring monetary stability, overseeing corporate banking operations, formulating fiscal policies, issuing government bonds, and managing the nation’s financial reserves.

How to Spot Counterfeit Vietnamese Dong Notes?

Identifying counterfeit Vietnamese Dong notes requires keen attention to several key features. One such feature is a narrow strip running vertically across the width of genuine notes, displaying the denomination visibly. Counterfeit bills often lack this distinct strip, offering a clear differentiation point. Ripped, stretched, or scratched counterfeit polymer notes are also signs of inauthenticity.

Additionally, genuine notes contain sections printed with optically variable ink. When these sections are rotated slightly, the color transitions from yellow to green and back again. Ultraviolet light reveals yet another discrepancy. Serial digits on genuine notes illuminate brightly under UV light, while those on counterfeit notes either do not light up at all or emit a weak glow. Finally, tilting banknotes reveals a metallic sheen and sparkle on the yellow thread running around the back of genuine bills.

How Do We Measure The Value Of VND?

The measurement of the Vietnamese Dong value is efficiently carried out using the custom VND Index, a valuable instrument for evaluating its relative strength in comparison to other currencies. This index functions as a comprehensive indicator, portraying the performance of the VND against a basket of other major currencies.

What is the Vietnamese Dong Index (VNDX)?

The Vietnamese Dong Index (VNDX) provides a comprehensive view of the Vietnamese Dong's performance, delivering valuable insights into its relative value compared to a diverse array of international currencies. This tool is essential for traders, policymakers, and analysts seeking a thorough understanding of how the VND values against other currencies.

Here are key aspects of the Vietnamese Dong Index:

1. The VND Index considers a diverse basket of major currencies, ensuring a holistic evaluation of the VND’s performance.

2. A rising VND Index signifies a strengthening position of the VND in relation to the other currencies included in the index.

3. Conversely, a declining VND Index signals a weakening position of the VND relative to the other currencies within the index.

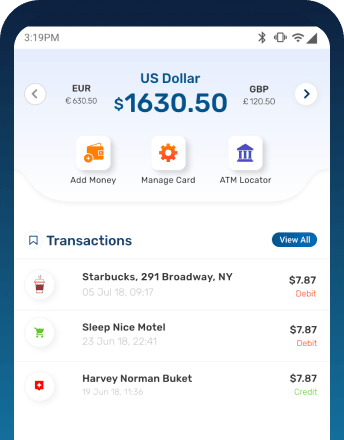

How to Buy or Sell VND in India?

You can buy or sell VND online at the best rates with BookMyForex, a leading forex platform in India. On our site, you will find the live & transparent VND rates as the rates get updated every 3 seconds. You get the following benefits when buying or selling VND:

1. BookMyForex offers the best rate for VND to INR, or vice versa

2. You can place your order online 24x7 at live rates

3. Rates are compared across hundreds of money changers in your area

4. Same-day delivery of VND currency notes is available

5. Freeze your desired rates for up to 3 days by paying a refundable deposit of 2%