Singapore Dollar (SGD) Overview

The Singapore dollar (SGD) is the official currency of Singapore. To distinguish it from other dollar-based currencies, the Singapore dollar is denoted by the symbol S$ or SG$. The abbreviation, SGD, is also commonly used to refer to the currency in financial transactions, trade, and official documentation. Singapore dollar banknotes are available in a range of denominations and the currency is managed and regulated by the Monetary Authority of Singapore.

Singapore Dollar Currency Facts

| SGD Stats | SGD Profile |

| Name: | Singapore Dollar |

| Nickname: | Sing, Buck, Dough |

| Symbol: | SG$, S$ |

| Date of Introduction: | June 12, 1967 (56 years ago) |

| SGD Currency in Circulation: | SG$100 billion |

| Banknotes: | Frequently used: $2, $5, $10, $50, $100, $1000 Rarely used: $1 |

| Dollar Notes Made of | Polymer |

| Current Singapore dollar Coins: | 5c, 10c, 20c, 50c, $1 |

| Dollar Coins Made of: | Nickel-plated steel |

| Countries using SGD | Singapore |

History of the Singapore Dollar

The history of the Singapore Dollar is marked by a transition from colonial-era currencies to the establishment of its own currency. Here is a comprehensive and historical overview of the currency:

1. Straits Dollar Era:

Singapore's early use of the Straits Dollar marked a period of colonial currency adoption. The Straits Dollar, introduced in 1845, became the primary medium of exchange until 1939. During this time, Singapore's economic landscape was heavily influenced by colonial trade and administration, laying the foundation for future developments in the region.

2. Malayan Dollar, Malaya and British Borneo Dollar:

The transition from the Straits Dollar to the Malayan Dollar in 1939 reflected the evolving economic dynamics of the region. Subsequently, the Malaya and British Borneo Dollar took center stage in 1953, showcasing the interconnected financial histories of Malaya and British Borneo, including Singapore.

3. Monetary Union Breakdown:

The breakdown of the monetary union in 1965 was a pivotal moment for Singapore. Gaining independence led to the establishment of a distinctive currency, and also for the official introduction of the Singapore Dollar.

4. Introduction of the Singapore Dollar:

On April 7, 1967, Singapore issued its inaugural coins and notes, introducing the Singapore Dollar. This move underscored the nation's autonomy and marked a crucial step in the financial sovereignty of the newly independent state.

5. Currency Administration and Mergers:

Initially managed by the Board of Commissioners of Currency, Singapore's currency administration underwent significant changes. The merger with the Monetary Authority of Singapore in 2002 streamlined financial oversight, enhancing the efficiency and stability of the currency.

6. Pegging to Foreign Currencies:

In its early years, the SGD was pegged to the British Pound Sterling, reflecting historical ties. A shift to the US Dollar later occurred in the early 1970s. From 1973 to 1985, it was pegged to a fixed and undisclosed trade-weighted basket of currencies, thereby ensuring stability while fostering international trade.

7. Shift to Floating Exchange Rate:

Post-1985, Singapore adopted a floating exchange rate for the SGD. This move allowed the currency to fluctuate within a controlled bandwidth, offering flexibility in response to market dynamics. The Monetary Authority of Singapore (MAS) played a pivotal role in overseeing this transition, contributing to Singapore's ability to guard against inflation.

8. Performance Post-2008 Financial Crisis:

Following the 2007–2008 financial crisis, the SGD emerged as one of the world's best-performing currencies. Singapore's strong financial center, stable housing prices, and sensible regulatory practices contributed to the SGD's strength. This period highlighted Singapore's reputation as one of the stable currencies.

Significance of the Singapore Dollar (SGD)

The significance of the Singapore Dollar (SGD) can be understood through various economic, financial, and historical factors. The currency is the 12th most traded currency worldwide, showcasing Singapore's position as a prominent currency in the forex market. Post the 2007-2008 financial crisis, the SGD demonstrated exceptional resilience, emerging as one of the world's best-performing currencies. The nation's exceptionally strong external and fiscal balance sheets, high per capita income, and sound macroeconomic policies enhance the SGD's status on the global stage.

The currency is fully backed by gold, silver, and other assets held by Singapore's central bank. This backing not only instills confidence in the currency but also reflects the country's commitment to maintaining a stable and secure financial system. Furthermore, Singapore's reputation as one of the world's most business-friendly environments, recognized by the World Bank, attracts international businesses and investors. Finally, the strength of Singapore's manufacturing and services sectors, serving as key drivers of economic growth since gaining independence in the 1960s, contributes significantly to the SGD's growing significance.

Current Singapore Dollar Notes & Coins

1. The Singapore dollar (SGD), like many others, follows a decimal system, being divided into 100 cents.

2. The banknotes come in various denominations, including S$2, S$5, S$10, S$20, S$25, S$50, S$100, S$1,000, and S$10,000.

3. Each banknote carries unique features and designs, reflecting the rich cultural history of Singapore.

4. The coins are available in values such as S$1 and S$5, 10, 20, and 50 cents.

5. The currency was initially produced by the Board of Commissioners of Currency. However, in a significant development in 2002, it merged with the country's central bank, the Monetary Authority of Singapore.

6. This merger streamlined the issuance and management of the Singapore dollar under a singular financial authority.

7. In addition to banknotes, the Monetary Authority of Singapore is responsible for minting a variety of coins.

8. The diversity in denominations, coupled with the detailed design and production supervised by the central bank, ensures that the Singapore dollar meets the various needs of its users.

How to Spot Counterfeit Singapore Dollar Notes?

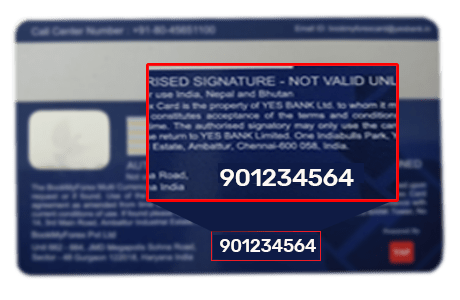

One of the most notable characteristics of SGD notes is the multicolored watermark featuring the image of the late Encik Yusof bin Ishak. When an authentic bill is held up to the light, this watermark appears three-dimensional, exhibiting various sections of light and dark appearance. Another way is to examine the security thread on the note. Holding the thread up to the light also reveals a series of writings, including the denomination number of the note and the word "SINGAPORE" in the four official languages.

Another noteworthy aspect is the alignment of the Singapore Lion insignia on the front of the note with the corresponding image on the back when viewed against the light. Ultraviolet light unveils another layer of security features. Authentic notes exhibit a vivid glow from the serial numbers and front seal when exposed to ultraviolet light. The fluorescent pigment used in these elements further enhances their visibility and authenticity. Lastly, the asymmetrical serial numbers on authentic notes safeguard the notes against counterfeiting.

How Do We Measure The Value Of SGD?

The measurement of the Singapore Dollar's (SGD) value is efficiently carried out using the SGD Index, a valuable instrument for evaluating its relative strength in comparison to other currencies. This index functions as a comprehensive indicator, portraying the performance of the SGD against a basket of other major currencies.

What is the Singapore Dollar Index (SGDX)?

The Singapore Dollar Index (SGDX) provides a comprehensive view of the Singapore dollar's performance, delivering valuable insights into its relative value compared to a diverse array of international currencies. This tool is essential for traders, policymakers, and analysts seeking a thorough understanding of how the SGD values against other currencies.

Here are key aspects of the Singapore Dollar Index:

1. The SGD Index considers a diverse basket of major currencies, ensuring a holistic evaluation of the SGD's performance.

2. A rising SGD Index signifies a strengthening position of the Singapore dollar in relation to the other currencies included in the index.

3. This suggests a positive trend, indicating increased purchasing power and enhanced competitiveness on the global economic stage.

4. Conversely, a declining SGD Index signals a weakening position of the Singapore dollar relative to the other currencies within the index.

5. This scenario implies diminished purchasing power and a reduced standing compared to its counterparts.

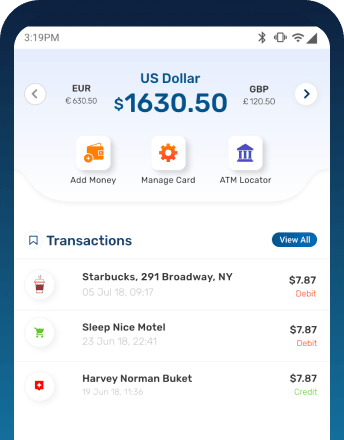

Benefits of buying/selling SGD from BookMyForex

You can buy or sell SGD online at the best rates with BookMyForex, a leading forex platform in India. On our site, you will find the live & transparent SGD rates as the rates get updated every 3 seconds. You get the following benefits when buying or selling SGD :

1. BookMyForex offers the best rate for SGD to INR, or vice versa

2. You can place your order online 24x7 at live rates

3. Rates are compared across hundreds of money changers in your area

4. Same-day delivery of SGD currency notes is available

5. Freeze your desired rates for up to 3 days by paying a refundable deposit of 2%