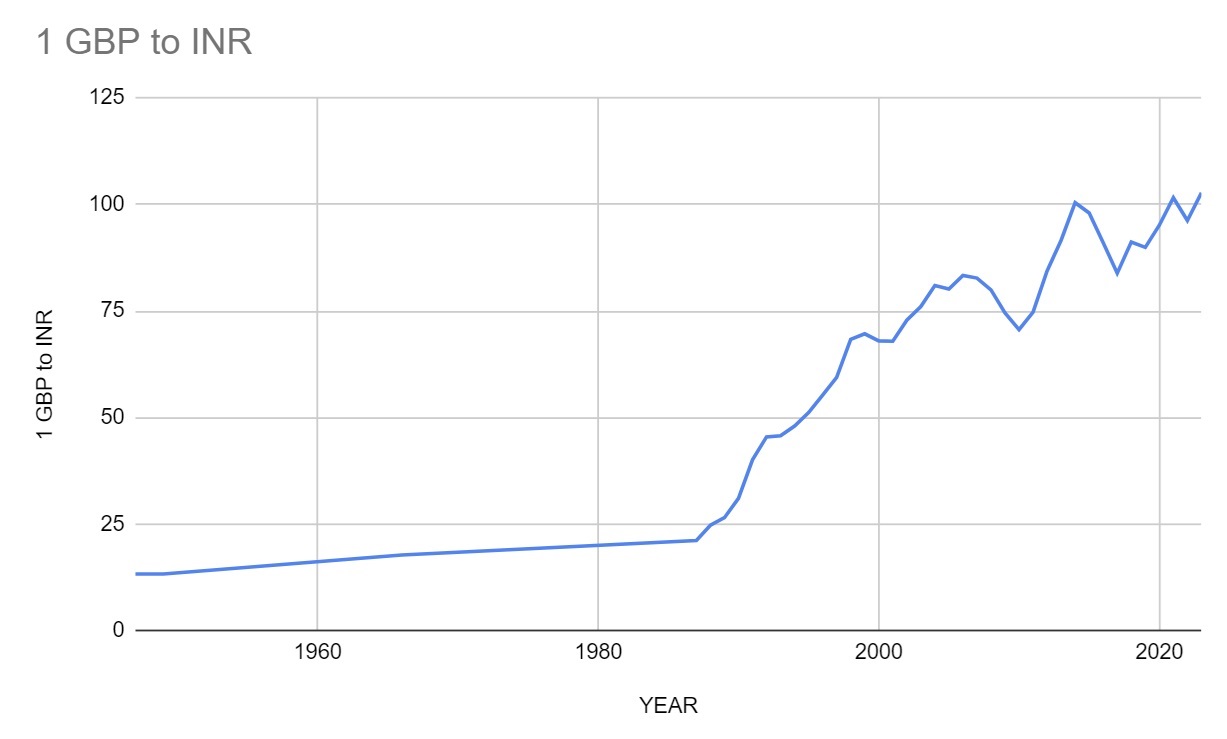

Summary: Over the course of time, multiple historical events have impacted the GBP to INR exchange rate. Take a look at some of the notable events that have impacted the GBP to INR exchange rate from 1947 till today.

About Pound Sterling

Abbreviated as GBP, Pound Sterling is the official currency of the United Kingdom and its notes are available in denominations of £5, £10, £20, and £50. Besides being the UK’s national currency, GBP is also accepted in places including South Georgia, Gibraltar, and the Isle of Man. Ranked after the Japanese Yen (JPY), the pound sterling (GBP) is the fourth most actively traded currency in the forex market. The issuance of GBP banknotes is undertaken by the Bank of England.

About Indian Rupee

Abbreviated as INR, the Indian Rupee is the official currency of India, with banknotes available in denominations of ₹10, ₹20, ₹50, ₹100, ₹200, ₹500. The official currency symbol ‘₹’ was introduced in 2010, inspired by the Devanagari letter ‘र’ and the Latin letter ‘R’, with two horizontal stripes representing the national flag and the equality sign. The Reserve Bank of India (RBI), India’s central bank, is responsible for issuing and regulating the currency. The rupee is primarily used in India but is also accepted in neighboring countries like Nepal.

Value of 1 GBP to INR from 1947 to 2025

Given below is a table listing the value of 1 GBP in relation to INR from 1947 to 2025.

| YEAR | 1 GBP to INR | YEAR | 1 GBP to INR |

|---|---|---|---|

| 1947 | 13.33 | 2005 | 80.15 |

| 1949 | 13.33 | 2006 | 83.36 |

| 1966 | 17.76 | 2007 | 82.73 |

| 1987 | 21.18 | 2008 | 79.97 |

| 1988 | 24.75 | 2009 | 74.56 |

| 1989 | 26.52 | 2010 | 70.65 |

| 1990 | 31.07 | 2011 | 74.77 |

| 1991 | 40.1 | 2012 | 84.41 |

| 1992 | 45.48 | 2013 | 91.6 |

| 1993 | 45.73 | 2014 | 100.41 |

| 1994 | 48.01 | 2015 | 98 |

| 1995 | 51.17 | 2016 | 91.03 |

| 1996 | 55.28 | 2017 | 83.87 |

| 1997 | 59.44 | 2018 | 91.19 |

| 1998 | 68.33 | 2019 | 89.92 |

| 1999 | 69.66 | 2020 | 95.12 |

| 2000 | 67.99 | 2021 | 101.56 |

| 2001 | 67.92 | 2022 | 96.22 |

| 2002 | 72.85 | 2023 | 102.73 |

| 2003 | 76.05 | 2024 | 104.41 |

| 2004 | 80.96 | 2025 | 107.38 |

The History of the British Pound

It might sound surprising, but the pound is one of the world’s oldest currencies. The word “pound” finds its roots in the Latin phrase – “libra pondo”, a term that was indicative of weight in ancient Rome. The usage of the pound dates back to the Anglo-Saxon era in 775 AD when it was recognized as a unit of currency. Back in Anglo-Saxon England, 1 GBP was worth 240 silver pennies. The first time the pound coin emerged was in 1489 when Henry VII was the monarch of England.

The History of the Indian Rupee

The Indian Rupee (INR), represented by the symbol ₹, has a long and fascinating history. The word “rupee” comes from the Sanskrit term “rūpya,” which means “wrought silver” or “a coin.” The earliest records of currency usage in India date back to the 6th century BCE, making the rupee one of the world’s oldest currencies. Over time, the rupee saw many changes, as discussed below.

Historical events that noticeably impacted the GBP to INR rate

The Great Britain Pound and the Indian Rupee share an old and profound relationship that dates back to the colonial era. INR was pegged to the pound in 1947 when India broke away from the shackles of Britishers. The value of 1 Pound to INR in 1947 was equal to 13.33. Whereas one pound was worth $4.03 at the time of independence. Let’s take a look at how the GBP to INR exchange rate has changed from 1947 to the present day.

1. Devaluation of the pound in 1949

UK’s Labor Chancellor Hugh Dalton put forth a deflationary budget proposal in 1947 to improve trade balance and handle the management of excessive debt. The Dalton devaluation move was intended to reduce inflation and stabilize exchange rates. Since Dalton’s effort failed to solve convertibility issues, public confidence dampened and there was a mass departure towards the US dollar. In fact, Dalton was compelled to quit his position as his proposed plan did not turn out to be as successful as he claimed it would.

In 1947, it was announced by Sir Stafford Cripps that the pound sterling would be subject to a downward adjustment. As a result, GBP was made to undergo a devaluation of 30% and 1 pound became equal to $2.80. However, this led to a corresponding devaluation of the Indian rupee, which was pegged to the pound at the time. The GBP to INR rate at the time of the devaluation was 13.33. After the devaluation, the rate became 13.30.

2. Pound in your pocket” devaluation – 1967

The UK government devalued the pound again in 1967. This devaluation was not as severe as the 1949 devaluation, but it still had a significant impact on the GBP to INR rate. The pound lost 14.3% of its value against the rupee. The 1967 pound-in-your-pocket devaluation led by Prime Minister Harold Wilson was an attempt to induce economic growth. Sadly, the move turned out to be a national failure on all fronts. Wilson assured the citizens in a live broadcast that the devaluation which was about to follow would have no adverse effect on the “pound in their pocket”. On the contrary, the value of the pound underwent a considerable devaluation of 14%, thereby rendering 1 pound equal to $2.40.

3. Dissolution of Bretton Woods system in 1971

The UK’s economic growth came to a grinding halt in the 1970s owing to the rapidly rising inflation rates. Things worsened with the collapse of the Bretton Woods System, which was a global currency exchange regime that fixed the US dollar to gold. Owing to the trade deficit and economic hardship faced by the US, President Richard Nixon invalidated the convertibility of USD to gold. Based on the Bretton Woods agreement, the pound sterling was indirectly backed by gold as GBP was pegged to the US dollar.

When the gold standard was abandoned by the US, GBP became a free-floating currency and remained stable for a while. However, the runaway inflation in the following years threatened the sustainability of GBP due to which it faced major fluctuations against the USD. In 1985, the pound sterling witnessed a considerable drop of £1 being equal to USD 1.05. The GBP to INR rate at the time of the dissolution of the Bretton Woods system was 15.25. In the months following the dissolution, the rate fluctuated significantly, but it eventually settled down at around 18.80.

4. Global financial crisis of 2008

The inception of the global financial crisis of 2008 paved the way for the biggest economic downturn in the UK. While it is hard to pinpoint the main reason for the crisis, it was brought about by various factors including poor financial regulation, imprudent investment choices, etc. The crisis had a deteriorating impact on the UK’s economy with retail sales declining significantly.

The housing market collapsed and renowned property builders began announcing cutbacks to avoid losses. In 2009, the British Pound hit the biggest low against USD in 24 years at £1=$1.35. The global financial crisis of 2008 had a significant impact on the GBP to INR rate. The value of the pound fell sharply during the crisis, and the GBP to INR rate reached a record low of 74.56 in 2009.

5. Withdrawal from the EU in 2016

Britain has been affiliated with the European Union (EU) since 1973. While the country was a member of the EU, it was always reluctant to adopt the Euro as its national currency. The UK wanted to retain the pound as its currency because it was an integral part of its national identity. The matter finally got settled when the Brexit referendum was held in 2016 to ask the electorate whether the UK should carry on its membership with the EU or abandon it. 52% of people voted in the favor of the UK to revoke its membership with the EU.

The immediate aftermath of this event caused the sterling to decline sharply. The UK’s decision to withdraw from the European Union in 2016 also had a significant impact on the GBP to INR rate. The value of the pound fell sharply following the Brexit vote, and the GBP to INR rate reached another record low of 83.87 in 2017.

6. Outbreak of Coronavirus Pandemic – 2020

We all know that the outbreak of COVID-19 caused substantial job losses and halted the progress of businesses across sectors. The pandemic detrimentally impacted trade in countries all around the world including India and UK.. The Reserve Bank of India intervened to support the value of the rupee. This somewhat helped to put downward pressure on the GBP to INR rate.

7. UK-EU trade negotiations – 2020

The UK’s withdrawal from the European Union (EU) was followed by a period of trade negotiations between the UK and the EU. The UK and the EU finally reached a trade agreement in December 2020, which provided strength to the GBP. The GBP to INR exchange rate was 93.75 on December 31, 2020, the day before the UK and the EU reached a trade agreement. The GBP to INR rate in January 2021 after the agreement was between 99.16 and 100.20.

8. Bank of England interest rate hikes – 2021

The Bank of England has raised interest rates by a total of 2.25 percentage points since December 2021 in an effort to combat inflation. This has contributed to the strengthening of the GBP against the INR. The GBP to INR rate strengthened by approximately 8% since the Bank of England began raising interest rates.

9. Russia-Ukraine war – 2022

The war in Ukraine has had a negative impact on the global economy, including the UK. The Bank of England raised interest rates in an effort to combat inflation. However, the Bank of England’s interest rate hikes have not been enough to offset the impact of the war in Ukraine. As a result, the GBP to INR exchange rate fell to 96.22 INR in 2022.

10. Global Economic Slowdown – 2023

The year 2023 witnessed a slowdown in the global economy, which put pressure on the GBP, but not as significantly as other currencies. The UK economy might have shown more resilience and gained strength against other currencies including INR. India faced its own set of challenges in 2023, including potential capital outflows and a widening current account deficit. This could have put downward pressure on the INR, contributing to the GBP’s relative strength against the rupee in 2023.

11. Interest Rate Divergence -2024

One of the primary drivers behind the strengthening of GBP against INR in 2024 was the difference in interest rates between the UK government and the Indian central bank. The UK government implemented higher interest rates to combat inflation and maintain financial stability. In contrast, the Indian central bank maintained lower interest rates to support economic growth.

When interest rates are higher in the UK compared to India, it attracts more foreign investment flows into the UK, increasing demand for GBP. This increased demand, combined with a limited supply of GBP in the market, causes its value to appreciate against INR.

12. Reserve Bank of India’s Forex Strategy – 2025

Economists predict that in 2025, the Reserve Bank of India (RBI) may reassess its foreign exchange policy and ease its control over the rupee. Currently, the Indian rupee stands at its strongest level in over two decades against major global currencies in trade-weighted terms. Any shift in the RBI’s approach could impact the rupee’s valuation, potentially influencing exchange rates against currencies like the British Pound (GBP).

Also Read:-

1 USD to INR from 1947 to 2025: Historical Exchange Rates Explained

1 AED to INR from 2008 to 2025, Historical Exchange Rates Explained

1 CAD to INR from 1947 to 2025, Historical Exchange Rates Explained

1 EUR to INR from 1990 to 2025, Historical Exchange Rates Explained

1 AUD to INR from 1966 till now, Historical Exchange Rates Explained

1 THB to INR from 1947 to 2025, Historical Exchange Rates Explained

1 INR to PKR from 1947 to 2025, Historical Exchange Rates Trend Explained