Summary: Over the course of time, multiple historical events have impacted the AED to INR exchange rate. Take a look at some of the notable events that have impacted the AED to INR exchange rate from 2008 till today

Introduction:

The United Arab Emirates (UAE) has AED as its official currency, a change implemented on May 19, 1973, when it replaced the Qatari riyal and the Dubai riyal. Prior to this, the Trucial States, which later formed the UAE, utilized the Gulf Rupee—a currency pegged to the Indian Rupee.

Given the diverse reasons for visiting the UAE from India, such as vacations, business trips, and educational pursuits, the AED to INR exchange rate holds significant relevance today.

It is imperative to note that the exchange rate between the AED and the INR is constantly fluctuating. This fluctuation can be attributed to a number of factors, such as the economic and political events in the countries, global economic trends, and the supply & demand for both currencies.

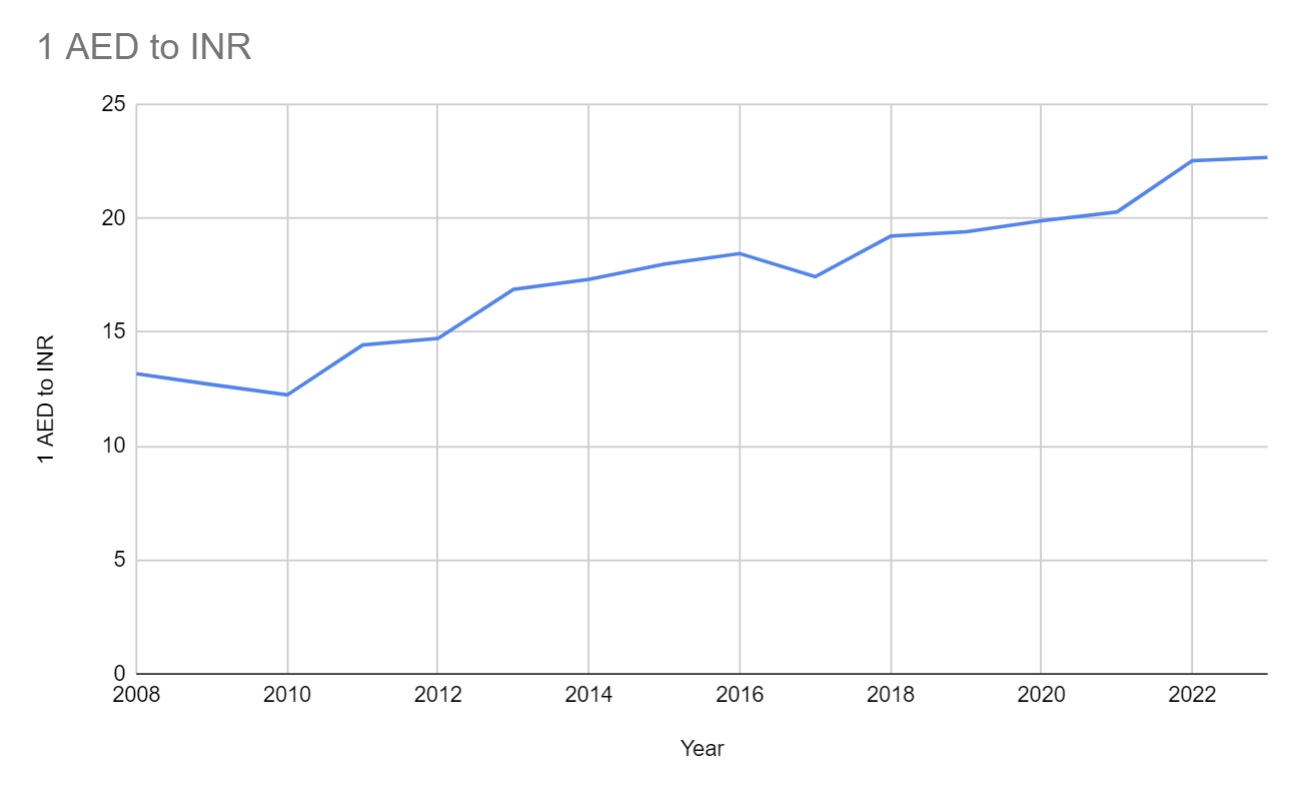

Value of 1 AED to INR from 2008 till today

Given below is a table listing the value of 1 AED in relation to INR from 2008 to 2023

| Year | 1 AED to INR | Year | 1 AED to INR |

|---|---|---|---|

| 2008 | 13.18 | 2009 | 12.70 |

| 2010 | 12.25 | 2011 | 14.44 |

| 2012 | 14.73 | 2013 | 16.88 |

| 2014 | 17.32 | 2015 | 17.99 |

| 2016 | 18.45 | 2017 | 17.44 |

| 2018 | 19.22 | 2019 | 19.41 |

| 2020 | 19.89 | 2021 | 20.28 |

| 2022 | 22.53 | 2023 | 22.67 |

| 2024 | 22.78 | 2025 | 23.64 |

Historical Events That Noticeably Impacted AED to INR Rate

Over the past few years, several major events have significantly impacted the exchange rate between the United Arab Emirates Dirham (AED) and the Indian Rupee (INR). These events have played a crucial role in shaping the value of the currencies.

Here is a list of some notable events along with their impact on the AED to INR rate:

1. Global Financial Crisis (2008)

The global financial turmoil of 2008 had its origins in the United States but quickly spread its impact worldwide. It stemmed from a mix of factors, including risky practices in mortgage lending, questionable investment strategies, and inadequate financial oversight.

One notable consequence of this crisis was a substantial drop in crude oil prices. This proved advantageous for the Indian economy due to the lowering of import costs. Consequently, the Indian Rupee gained strength against the United Arab Emirates Dirham (AED). Conversely, the UAE suffered an economic slowdown during this period, resulting in a decline in the AED’s value relative to the Rupee in the subsequent years.

2. The Arab Spring uprisings (2011)

In 2011, the Arab Spring uprisings significantly affected crude oil prices, and this had a negative impact on the Indian economy. The primary reason was India’s heavy reliance on oil imports. As oil prices surged, India’s import costs rose considerably, resulting in a larger trade deficit. Consequently, the value of the Indian Rupee declined against the United Arab Emirates Dirham (AED) during that period.

3. Expo 2020 Dubai Announcement (2013)

The announcement of Expo 2020 Dubai had a positive impact on the UAE economy, leading to increased investments and economic growth. The UAE government invested heavily in infrastructure and development in preparation for Expo 2020. This investment led to increased economic activity and job creation. The event also attracted significant foreign investment.

The positive impact of Expo 2020 on the UAE economy was reflected in the AED to INR rate. The AED appreciated slightly against the INR.

4. Indian Rupee Devaluation (2014)

In 2014, the Indian government devalued the INR as part of its efforts to boost exports and draw in more foreign investments. To achieve this, the government permitted the Rupee to float freely in the forex market. Due to this, the Indian Rupee depreciated against several currencies, including the United Arab Emirates Dirham (AED).

Later, the Indian government adopted various measures to alleviate the adverse consequences of the devaluation. These measures included offering subsidies to exporters and facilitating the import of essential goods. Additionally, they implemented strategies to restore stability to the Rupee, which included intervening in the foreign exchange market.

5. Indian Rupee demonetization (2016)

In 2016, the Indian government demonetized the 500 and 1000 rupee notes in an effort to combat corruption and black money. The government allowed people to exchange their old notes for new ones at banks and post offices, but there were strict limits on how much money could be exchanged.

The demonetization had a negative impact on the Indian economy and resulted in a shortage of cash and a notable downshift in economic growth. Thus, the Indian Rupee also depreciated against the United Arab Emirates Dirham (AED) and various other currencies in the ensuing months.

6. Political Turmoil in the Middle East (2017)

Throughout 2017, political instability and conflicts in the Middle East, particularly in countries like Syria and Yemen, affected the economies of the region. The uncertainty surrounding these events had a noticeable impact on the Emirati Dirham to Indian Rupee exchange rate and AED deprecated against the Indian Rupee.

7. COVID-19 pandemic (2020)

The COVID-19 pandemic in 2020 had a negative impact on both the Indian and UAE economies. The pandemic led to a slowdown in economic growth and a decline in tourism. The rupee fell against the AED and other currencies, however, the Reserve Bank of India intervened to support the value of the rupee which kept the AED to INR rate somewhat stable.

8. UAE-Israel Peace Agreement (2020)

In September 2020, the UAE and Israel signed a peace agreement, normalizing diplomatic relations between the two countries. This development led to increased trade and investment opportunities, positively impacting the AED and contributing to its appreciation against the INR.

9. Oil Price Fluctuations (2021-2022)

As economies began to recover after the pandemic, global oil demand increased. The UAE benefited from rising oil prices, enhancing its fiscal position. Conversely, India, as a major oil importer, faced increased import bills, exerting pressure on the INR. These dynamics led to the appreciation of the AED relative to the INR during this period.

10. UAE Central Bank’s Monetary Policy (2024)

In December 2024, the Central Bank of the UAE (CBUAE) lowered its base rate by 25 basis points to 4.40%, in line with the Federal Reserve’s rate cut. This monetary policy change aimed to curb inflation and stabilize the economy. Although the AED is pegged to the US Dollar, such policy adjustments could have impacted the AED’s value against other currencies, including the INR.

11. Indian Central Bank’s Liquidity Measures (2025)

In January 2025, the Reserve Bank of India (RBI) unveiled a plan to inject ₹1.5 trillion into the banking system to address liquidity shortages. This move aimed to reduce short-term lending rates and stimulate economic growth. This could lead to a depreciation of the INR against the AED, as increased liquidity may also weaken the currency in the short term.

General Factors Influencing AED & INR Exchange Rates

The United Arab Emirates and India have a long-standing and well-established relationship, which has caused a substantial flow of goods/services, and capital between these two countries. The relationship between the AED and INR is subject to various factors, a few of which are mentioned below:

1. Trade Balance: The balance of trade between the UAE and India is a crucial factor that determines the exchange rate. Let’s say that the UAE imports more goods and services from India than it exports, in this case, the demand for INR increases, leading to an appreciation of the AED against the INR. Conversely, if the UAE exports more than it imports from India, then it results in the decline of the AED against the INR.

2. Economic Factors: Macroeconomic indicators such as GDP growth, inflation rates, interest rates, and government policies impact the exchange rate between the AED and INR. A scenario where the UAE experiences higher economic growth than India can contribute to the appreciation of the AED. Conversely, if India witnesses higher inflation rates, it may lead to the depreciation of the INR against the AED.

3. Market Sentiments: Market sentiments and speculations also play a significant role in determining the exchange rate. Factors such as political stability, economic outlook, and investor confidence can influence currency demand and supply, thereby affecting the relationship between AED to INR.

4. Central Bank Interventions: Both the Central Bank of the UAE and the Reserve Bank of India intervene to stabilize their respective currencies. These interventions may involve buying or selling currencies to influence their values. The actions of these central banks impact the relationship between the AED/INR currency pair.

Also Read:-

1 CAD to INR from 1947 to 2025, Historical Exchange Rates Explained

1 EUR to INR from 1990 to 2025, Historical Exchange Rates Explained

1 AUD to INR from 1966 till now, Historical Exchange Rates Explained

1 THB to INR from 1947 to 2025, Historical Exchange Rates Explained

1 INR to PKR from 1947 to 2025, Historical Exchange Rates Trend Explained

1 GBP to INR from 1947 to 2025: Historical Exchange Rates Explained

1 USD to INR from 1947 to 2025: Historical Exchange Rates Explained