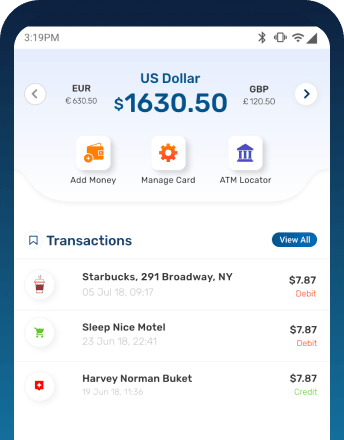

The BookMyForex Mobile App

Enjoy added benefits and wave goodbye all your Forex woes by downloading our mobile app

- Real time tracking & sorting of transactions

- Easy and free of cost currency to currency exchange

- Secure online transactions with disposable virtual cards

- Hassle free fund reloads & unloads on card

- Enjoy bank grade in-app security

- Nearby ATM tracker