When making international money transfers, two key identifiers are commonly used: IBAN (International Bank Account Number) and SWIFT (Society for Worldwide Interbank Financial Telecommunication) codes. Both play essential roles in facilitating secure transactions, but they serve distinct purposes.

What is an IBAN Number?

An IBAN is a globally recognized standard used to uniquely identify bank accounts for international transactions. It consists of up to 34 alphanumeric characters, with each section serving a specific identification purpose.

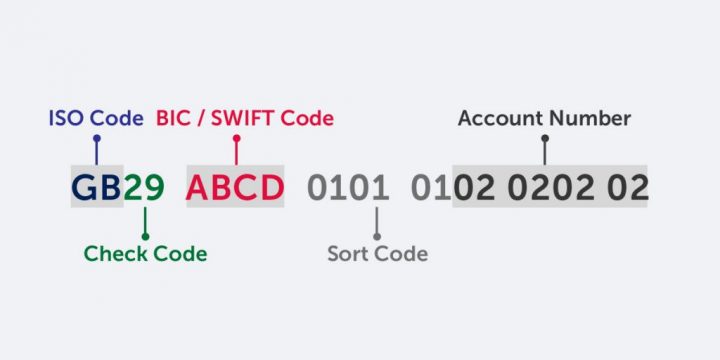

Structure of an IBAN Number:

The structure of an IBAN varies by country but follows a standard format:

1. Country Code – A two-letter country identifier (e.g., AT for Austria, GB for the United Kingdom).

2. Check Digits – Two numbers that help validate the IBAN.

3. Bank Identifier Code – A unique bank code assigned to each financial institution.

4. Branch Code – A code for the specific branch of the bank.

5. Account Number – The individual’s unique account number.

Examples of IBANs:

IBAN for Austria – AT483200000012345864

IBAN for United kingdom – GB33BUKB20201555555555

Why is IBAN Important?

1. Ensures accuracy in international payments by reducing errors.

2. Helps validate bank details before transferring funds.

3. Standardizes bank account identification across multiple countries.

4. Reduces transaction failures.

Historical Background of IBAN

Before the IBAN system, cross-border payments were complex and prone to errors due to missing routing information. This often resulted in delayed payments and additional charges.

In 1997, the International Organization for Standardization (ISO) proposed the IBAN system to streamline international transactions. After revisions, the European Committee for Banking Standards (ECBS) approved the standardized format, and in 2007, a revised version was introduced, solidifying IBAN as a global standard.

Difference Between IBAN and SWIFT Code

While both IBAN and SWIFT codes are used in international transactions, they serve different purposes:

| Feature | IBAN | SWIFT Code |

|---|---|---|

| Purpose | Identifies a specific bank account | Identifies a bank or financial institution |

| Format | Up to 34 alphanumeric characters | 8 to 11 characters (e.g., BOFAUS3N) |

| Usage | Used to route payments to the correct bank account | Used for communication between banks about transactions |

| Coverage | Primarily used in Europe, the Middle East, and some other regions | Used worldwide |

Do You Need Both IBAN and SWIFT Code?

Yes, for most international transactions, both IBAN and SWIFT codes are required. While IBAN ensures the correct account is credited, SWIFT facilitates secure interbank communication.

FAQs on IBAN Number

Q1) Where Can I Find My IBAN Number?

You can find your IBAN in your bank statement, online banking portal, or mobile banking app. If it is not readily available, contact your bank.

Q2) Why Do I Need an IBAN Number?

IBAN ensures accurate international payments and is mandatory in many countries to prevent errors and delays.

Q3) What does an IBAN number look like?

An IBAN consists of a two-letter country code, check digits, a bank identifier, and an account number. The exact format varies by country. There are not more than 34 characters in IBAN.

Q4) Is IBAN the same as the account number?

No, an IBAN includes the account number but also contains additional details like the bank and country codes for international identification.

Q5) Which countries use IBAN?

IBAN is mandatory in many countries, including Andorra, Austria, Bahrain, Belgium, Bosnia, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Faroe Islands, Finland, France, Georgia, Germany, Gibraltar, GreatBritain, Greece, Greenland, Guernsey, Hungary, Iceland, Ireland, Isle of Man, Italy, Jersey, Jordan, Kazakhstan, Kuwait, Latvia, Lebanon, Liechtenstein, Lithuania, Luxembourg, Macedonia, Malta, Moldova, Monaco, Montenegro, Netherlands, Norway, Palestine, Poland & Portugal.

Q6) Is IBAN enough to transfer money?

No, when you make an internal transfer, you will have to take into account the various details of the beneficiary and his bank details. You also need Swift code, which intimates the bank about the internal remittances.

Q7) How do I transfer money to an IBAN number?

The transfer process is rather simple. Obtain the recipient’s IBAN and SWIFT code. Log in to an online money transfer platform or visit your bank. Enter the beneficiary details (name, bank details, IBAN, and SWIFT code). Select the currency and amount. Confirm and process the payment.

Q8) Can I send money without IBAN?

Not all banks and countries in the world use the IBAN for the transfer of money. If IBAN is not used in the recipient’s country, you can use alternative methods like SWIFT Code, BIC, or national routing codes for international payments.