Planning your dream Europe trip or that long-awaited family vacation? You’ve probably heard about TCS on foreign travel and wondered how much extra you’ll need to pay upfront and whether you’ll get it back.

Budget 2026 slashes TCS rates for travelers. Overseas tour packages now attract just 2% TCS from the first rupee, a major drop from past rates. Other forex purchases face 20% TCS above ₹10 lakh. All TCS is reclaimable via your tax return.

Here’s the good news: the new rules are clearer, the rates are lower for most travel purposes, and the refund process remains straightforward. Let’s break down exactly what’s changed and what it means for your next international trip.

What is Tax Collected at Source (TCS)?

Tax Collected at Source (TCS) is an advance tax mechanism where the seller collects tax from the buyer during specific transactions. When you purchase forex or book an international tour package, your bank or service provider collects TCS as per Income Tax Act Section 206C.

Here’s what many people don’t realize: TCS is not an extra tax you lose forever. It’s an advance payment that can be adjusted against your total income tax liability or claimed as a refund when filing your ITR.

Our article on TCS on Foreign Exchange (Forex) will give you the bigger picture on both foreign travel and foreign remittance.

The Big Changes: Budget 2026 Explained

TCS rules on foreign travel have evolved significantly:

October 2023: TCS jumped to 20% on forex purchases exceeding ₹7 lakh (except education and medical)

Budget 2025: Threshold increased to ₹10 lakh, providing some relief

Budget 2026 (effective April 1, 2026): Game-changing simplification—overseas tour packages now attract a flat 2% TCS from the first rupee.

Updated TCS Structure

| Type of Transaction | Earlier (Budget 2025) | Budget 2026 |

|---|---|---|

| Overseas tour packages | 5% up to ₹10 lakh, 20% above | Flat 2% from first rupee |

| General forex purchases (shopping, investment, etc.) | 20% above ₹10 lakh | 20% above ₹10 lakh |

| Education/Medical travel | 5% above ₹10 lakh | 2% above ₹10 lakh |

| Business travel | 0% | 0% |

Breaking Down Travel Categories

1. Overseas Tour Packages (Biggest Change!)

This is where Budget 2026 delivers maximum impact. Tour packages now have a simple, unified 2% TCS rate from the very first rupee.

Example: ₹8 lakh Europe tour package

1) Budget 2026 TCS: ₹8,00,000 × 2% = ₹16,000

2) Earlier: ₹8,00,000 × 5% = ₹40,000

3) You save: ₹24,000 in upfront cost

This dramatic reduction means you keep more money in your pocket during booking, even though the amount remains reclaimable.

2. Independent Forex Purchases (Non-Package Travel)

If you’re buying forex independently for shopping, sightseeing, or general expenses, the 20% TCS above ₹10 lakh threshold continues.

3. Education or Medical Travel

For education or medical purposes, TCS has been reduced from 5% to 2% on amounts exceeding ₹10 lakh.

Example: ₹12 lakh for medical treatment abroad

1) First ₹10 lakh → No TCS

2) Remaining ₹2 lakh → 2% = ₹4,000

3) Earlier: ₹2,00,000 × 5% = ₹10,000

4) You save: ₹6,000 upfront

Should You Worry About TCS on Foreign Travel?

Short answer: No.

Here’s why you can relax:

1. TCS is fully reclaimable: Every rupee collected as TCS can be adjusted against your tax liability or claimed as a refund.

2. Lower upfront costs: Budget 2026’s reduced rates mean you pay less during booking, easing immediate cash flow.

3. Simple refund process: You’ll receive a TCS certificate from your forex provider that makes claiming easy during ITR filing.

For salaried employees: You can share your TCS certificate with your employer, who can adjust it against your monthly TDS. This means you might see the benefit even before filing your annual return.

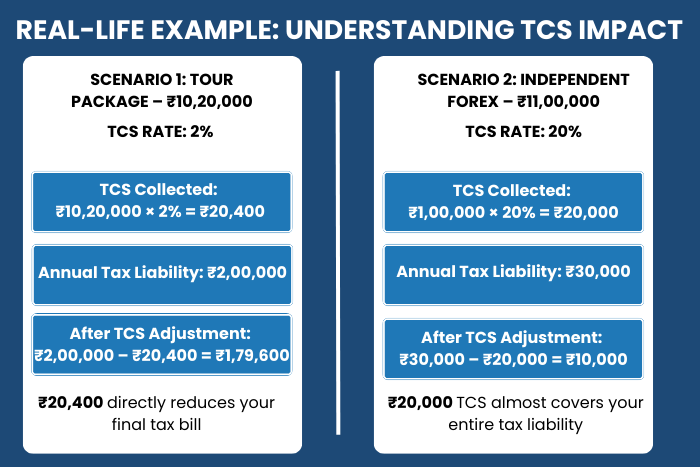

Real-Life Example: Understanding TCS Impact

Scenario 1: You book a ₹10,20,000 tour package in Budget 2026

1) TCS collected: ₹10,20,000 × 2% = ₹20,400

2) Your annual tax liability: ₹2,00,000

3) After TCS adjustment: You only pay ₹1,79,600 as net tax

4) Result: The ₹20,400 reduces your final tax bill

Scenario 2: You purchase ₹11 lakh independent forex

1) TCS collected: ₹1,00,000 × 20% = ₹20,000

2) Your annual tax liability: ₹30,000

3) After TCS adjustment: You only pay ₹10,000 as net tax

4) Result: The ₹20,000 TCS almost covers your entire tax liability

What Are the Steps to Claim the TCS Back?

If you are subject to TCS, it is crucial that you understand the financial implications and know how to claim your TCS. To claim TCS back, follow these steps:

1. Please ensure that you have all the required documents with you, including the TCS certificate, the acknowledgment receipt, and Form 26AS, if applicable.

2. The refund claim form should be filled out. You must attach all the necessary documents along with the refund claim form.

3. To claim a refund, submit the form as well as the documents to the Income Tax Department.

4. A refund claim will be processed by the Income Tax Department and the amount will be credited to the individual’s bank account.